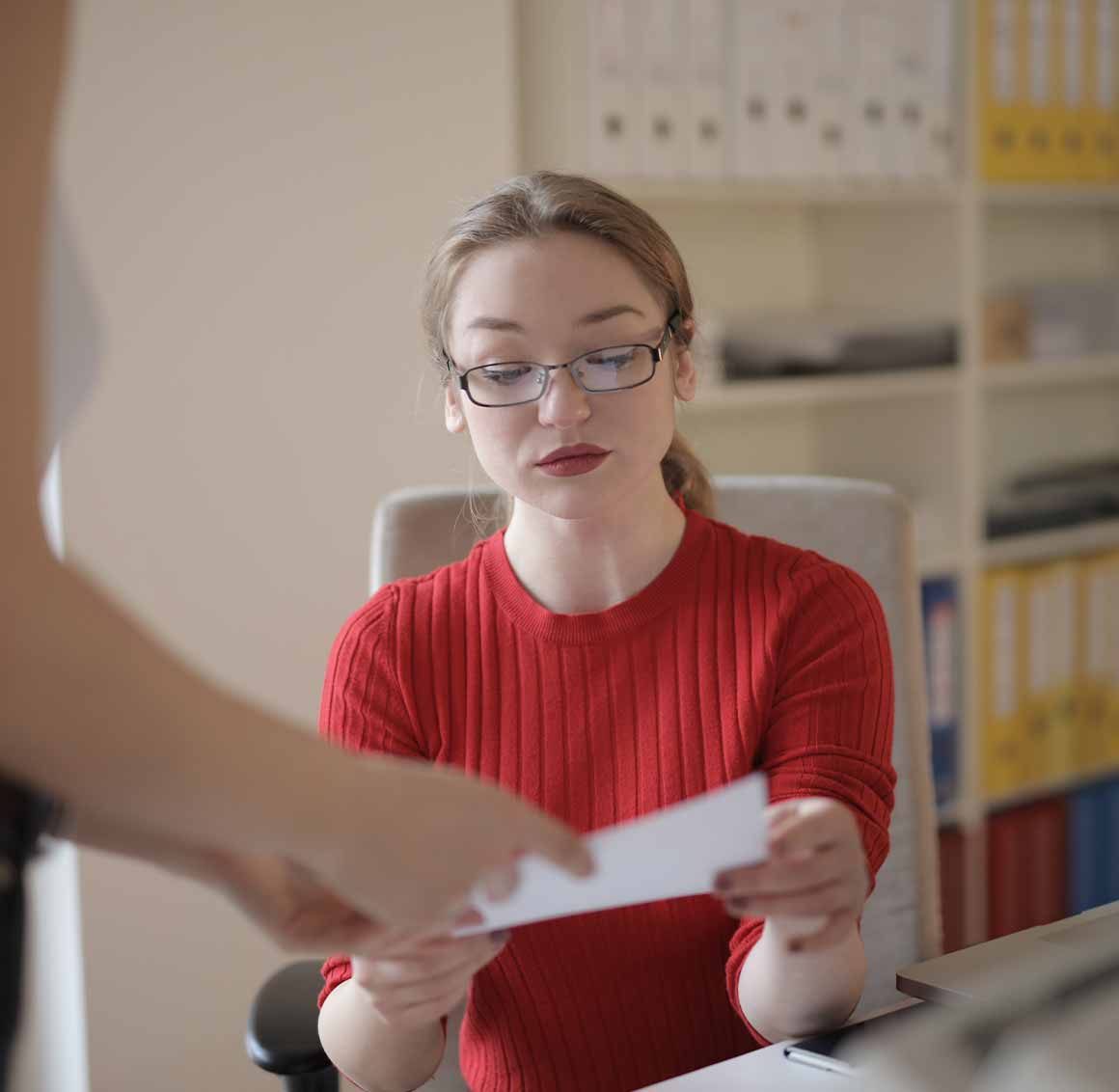

Worried about making the right business startup decision?

Contact us today for a consultation if you are considering starting up a new business.

We got your back.

JP Norman CPA will provide the guidance you need.

Understanding the different new business entity formation choices available can be overwhelming, but choosing the correct entity is an integral part of business success.

Our services include advising you on selecting the appropriate entity structure for your new business (i.e., C-Corporation, S-Corporation, Limited Liability Company (LLC), Partnership, Sole Proprietor, etc.).

We also offer:

- Assistance with the formation of your entity.

- Prepare and file your application for the entity’s Federal Tax Identification Number with the IRS.

- Provide accounting and bookkeeping advice as you begin your new role as a business owner.

- Determine potential payroll tax reporting requirements or independent contractor/consultant 1099 reporting requirements for your future employees and contractors.

- Assist in preparing projected financial statements or cash flow projections for your new venture.

Other business services we offer:

While accurate record keeping is essential for any business, it can also be complicated and time consuming. Find out more about how we can help.

Payroll processing and tax reporting is a burdensome task for many businesses. We can make your life easier by handling the hassle of payroll.

Businesses today are required to collect and submit sales taxes for many different localities. We can assist you in the preparation and submission of sales tax returns.